Some thirty years ago, when I was in my twenties, friends of my then wife were in the investment business. They were smart, frugal and sincere in their belief that to live and retire well people should set aside some money and invest a good chunk of it in equities.

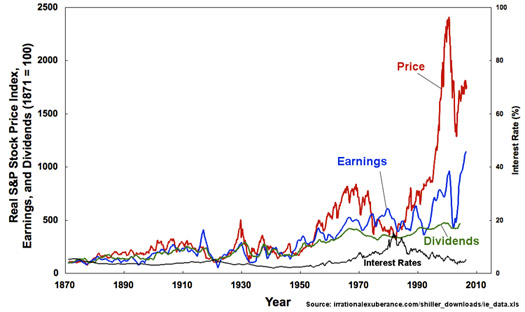

To drive home their point they gave me a business card sized, four-color graph of equity indices – similar to the one above – the Dow, the S&P, etcetera. It clearly showed that since the crash of 1929 stocks have gone up and down, but unlike a roller coaster, the trend was clearly up, up, up.

So, I invested the small sums I saved for retirement in stocks.

In the summer of 1987, my then wife was also friends with a woman who was married to the technical analyst Ralph Acampora. You may remember Mr. Acampora as one of the “elves” of the Louis Rukeyser days of the PBS television machine show “Wall Street Week.” He was often a featured guest.

At the time, I was a graduate student at New York University’s Stern School of Business. Mr. Acampora invited me to visit his “office,” which was actually a rather large walk-in vault. I don’t believe he or his partner ever closed the vault door. It was just space in the over-crowded, over-priced real estate market of Manhattan.

Inside the vault were graphs of every statistic known to man on clear plastic overlays. Placing one on top of another they searched for repeating patterns. Their job was to figure out what the market was going to do next.

From that surreal meeting I took away a single piece of sage advice: “The second you see interest rates go up, Charlie, bail-out of the market.” Back then bail-out meant get-the-hell-out, not get a hand-out.

In June of 1987 interest rates inched up. I sold my stocks. Ralph saved me a lot of money. I got back in the market in January 1988. After that, my luck ran out, in a number of different ways.

Question: Why?

Take a look at that chart again and the trajectory of S&P stocks prices. Up, up, up. The S&P needs to lose a whole bunch more before we’re back down to 1995 prices.

Answer: You and I are not the S&P 500.

Further: You and I, and people like us that must work for a living, have no business in the equities markets. Not in individual stocks. Not in mutual funds. Not even in a broad index fund like the S&P 500, which is most likely the best way to “invest” in equities.

Here are a few, just off the top of my head, reasons why:

- Picking stocks is for suckers. You can’t do it; I can’t do it, at least not anymore. There are just too many variables. Company financials and fundamentals mean nothing anymore. Time was the annual 10K reports, required by the SEC, would give you everything you needed to do a complete accounting analysis of a publicly traded company. Do you know how to do an accounting analysis? If you do, do you do one on every stock pick? No matter, there’s no longer enough information in the 10K to do one. Companies can hide all sorts of important information and totally obscure their bottom line value or lack thereof.

- External variables are unrelenting and capricious: war, weather, new laws and regulations, systemic economic shocks. You name it; you don’t know what’s going to happen next. Worse, some of this is manufactured by Big Greed itself to cheat you legally. I’ll say it again. You and I don’t have enough resources to play in this game.

- You’ll probably ignore what I’m telling you about publicly traded equities. Billions are spent to make you believe you can pick stocks, futures and currency exchange rates. Look at the television ads: A baby can do it, for only $7 a trade, and a very sincere Law & Order actor tells you every night that the investment firm he shills for is behind you all the way. To where? Why is it so important for them to make you feel smart and comfortable?

- Answer: Fees. All kinds of fees. You can’t get around the fees. You’re investing this small amount of retail money, under a million dollars, peanuts, and the fees will quickly wipe out any reasonable returns. The Big Greed boys are playing wholesale. What do you consider a reasonable return, 4%, 10%, 15%? Fees will wipe that out in no time.

- What return? Have you heard about Fast Trading? It’s probably just taking a nano-percent of the returns on a winner that would have gone to you, but it’s also taking a nano-percent of a loser, losing you more. You know about insider trading; what’s that costing you? How about derivatives? Do you think those fancy trades may be sucking some of the blood out of your investments? A friend who was a bartender once told me there were a dozen ways to steal from the house. Wall Street has thousands.

- By investing in publicly traded corporations you are feeding the machine that is screwing you up the butt. They are taking more money out of your pocket through deals that add nothing to the real economy. These same “quality” corporations are exporting jobs and using H-1b visas to drive down the wages they pay even the most technologically advanced workers. They have an unfair competitive advantage over small business in their ability to borrow and sell equity with no intent of ever repaying this funding. This, in turn, crushes local employment, farming and self-sufficiency.

In the face of all this, where should you put your money? A contributor to the Motley Fool said, “my recommendation is to focus on the highest-quality segment of U.S. corporations."

What would those be? As we have seen, no corporation, of whatever historic quality, is capable of protecting their assets in a consumer/worker slaughter-driven market dive.

Also, how can any small investor get a "fair" return relative to risk with the current situation of trade skimming and who knows what other black box scams?

Any rational investor opted out months ago and is waiting for the storm to pass and the enforcement of necessary regulations to create a market situation where the odds of success can be determined; where risk can be reasonably determined.

The current market is untenable. The only people participating are either: a) ignorant of the circumstances, b) blinded by greed or, c) the same operatives of Big Greed pulling the levers of this the biggest con of all time.

If I haven’t convinced you to sell your stocks, good luck.

If I have, now is a great time to sell, as this current bubble will soon burst. Put your cash in an insured account. Don’t worry about the paltry earnings rate. Anything is better than the rigged casino they call Wall Street.