$7 Billion to get you to use plastic.

Thursday, December 17, 2009 at 12:01PM

Thursday, December 17, 2009 at 12:01PM Advertising for banking, credit and debit card services: $7 billion a year.

Computer systems to process plastic transactions: $50 billion a year

814 lobbyists to get laws in your favor: $62.5 million in 2009

Having the government, taxpayers and customers under your thumb: Priceless.

As a taxpayer you already pay for one currency system: Cash. But the banks don’t make any money on cash transactions, so they’ve invented another system: Plastic.

Each has its advantages and disadvantages. You could even say that comparing the two is apples and oranges. But this isn’t about which currency system is best for what.

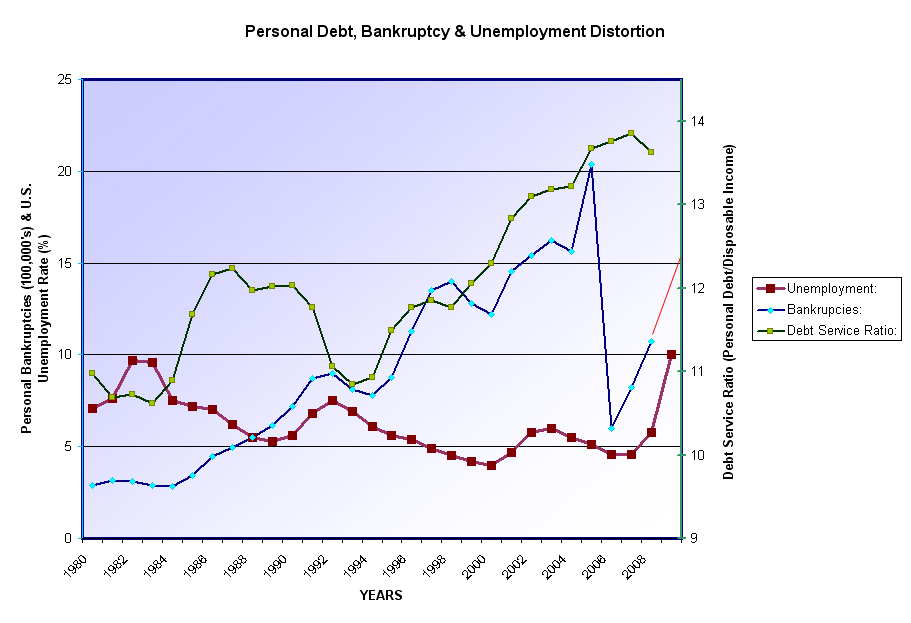

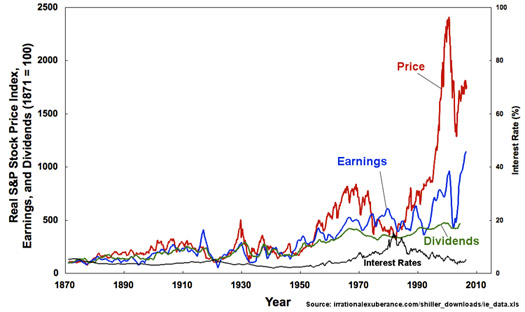

Big Banking has done nothing less than put the economy into near depression, take taxpayer money to the tune of $1 trillion dollars, curtail credit and lending, foreclose on homes, and up interest rates and fees. Something must be done, but what? What can we do to change the current stacked system?

I believe a simple, effective action against Big Banking is to Use Cash instead of plastic.

Use Cash is about getting some power back into the hands of people to toward ending the current unfair, usury and exploitive financial system.

It requires small, easy actions from large numbers of people willing to suffer a little inconvenience to send a message to Big Banking that enough is enough.

There are no pending plans in Washington to curb or cap usury interest rates, set limits on fees or penalties, stop home foreclosures or free up credit. Neither is their much happening to get Big Banks and Big Finance to end the casinoland games that gave us the financial crisis.

To get banking and monetary reform we first need to get the attention of the industry and the government. Letters, petitions, phone calls or political action will not work against the power and money at the disposal of Big Banking.

But there is one way to get the attention of any profit driven industry: deprive it of money.

Use Cash is an easy way to constrict an important flow of money to an industry that currently acts with impunity. Unlike a boycott, you need not deprive yourself of any particular product or service, including using your plastic. Just use cash more, credit and debit cards less.

This is how using cash will put a burning hurt on Big Banking.

When you use cash to buy something you automatically do the following: deprive Big Banking of 3.5 cents on every dollar spent, decrease the likelihood you will be paying interest on the amount of the purchase, and reduce your chances of incurring an overdraft, over limit or late payment fee, just to mention some of the ways Big Banking makes money on plastic transactions.

When merchants accept plastic for a transaction they pay an average 3.5 cents on every dollar. They get their money later rather than sooner. And somehow they have to pass along that cost to their customers, even those who paid cash, in their prices.

Plastic is a great convenience, but it does not come without a cost and ultimately the customer always pays that cost.

So, I’m asking both purchasers and merchants to participate.

When you purchase something use cash with the comforting knowledge you just took a little money out of the pocket of an industry that is abusing you.

Picture this, you just bought you and your new best friend for life coffees at a chic little cafe downtown, price $10. Pay cash – that’s at minimum 35 cents not going to Big Banking. Multiply that by hundreds-of-thousands of people, each a couple of transactions a day, and keep growing the movement until Big Banking cries uncle.

If you’re a merchant, please rethink your current policy of charging all customers for the cost of plastic transactions. Even the playing field by offering a 5% discount for cash transactions. You’ll have your payment on the day of the purchase and, instead of sending that 3.5% commission to Big Banking, your cash customers will benefit. I don’t know about you, but I like my customers a whole lot more than I like Big Banking right now.

Then, we all need to do one more thing to give the Banksters some sleepless nights. Spread the word. Go to www.UseCashMovement.org , download the free signs “Use Cash” and “5% Discount for Cash” tape them to your car windows and storefronts.

Go ahead. It will feel good to take a little power and money away from Big Banking and eventually we’ll get a fairer financial system.

Okay, one question: If you’re not willing to do this, what are you willing to do get change before it’s too late?

1) [Source: Brandweek, Nov. 16, 2009 http://www.brandweek.com/bw/content_display/news-and-features/direct/e3i8ccf864b12d44b62c9f134a54f95b745 ]

2) [Source: Information Security magazine, January 15, 2009 http://searchfinancialsecurity.techtarget.com/news/article/0,289142,sid185_gci1345047,00.html ]

3) [Source: Senate Office of Public Records, reported by OpenSecrets.org, downloaded October 26, 2009 http://www.opensecrets.org/lobby/indus.php?lname=F&year=a ]

chaz valenza | Comments Off |

chaz valenza | Comments Off |